print tax invoice airasia

Accounts will be updated within two 2 business days of receipt of payment submission. 94-2805249 INVOICE NUMBER 42716597 INVOICE DATE 01-Feb-2016 YOUR PO.

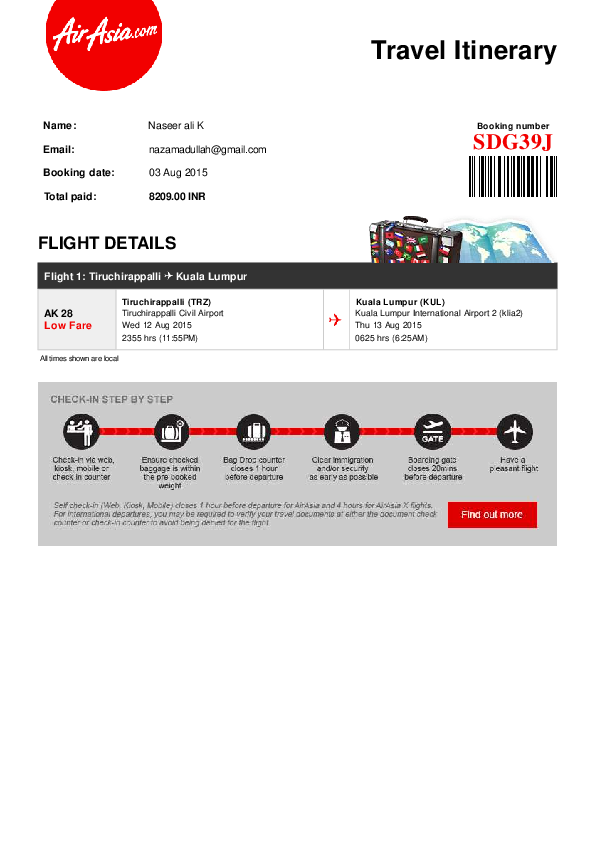

Pdf Ticket Sample Nasim Ahmad Academia Edu

If the origin of the travel is outside India GST is not applicable on the ticket hence GST invoice is not issued.

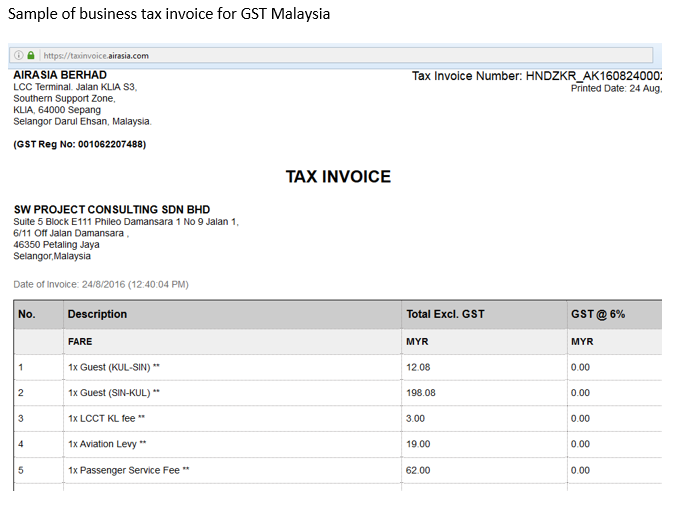

. When you make a taxable sale of more than 8250 including GST your GST-registered customers need a tax invoice to claim a credit for the GST in the purchase price. SW Project Consulting Sdn Bhd GST System Changes. Piscataway Township works throughout the year to keep our roads in good condition.

Please enter Origin Please enter 3 minimum characters. The most difficult and time consuming season to do so is the winter when sometimes potholes form after a thaw from freezing temperatures. Invoice federal tax id.

Air India has completed filing of GSTR 1 for the months from July 2017 to November 2017. NUTLEY VOLUNTEER EMERGENCY AND RESC 119 CHESNUT STREET NUTLEY NJ 07110 EXEMPT ORGANIZATION NUMBER 237-144. A simple invoice template that stores the important details of the product price and the total amount of the bill.

From 1 st September 2018 for reissuance or refund of air ticket ST will not be refundable. Air Asias resources and FAQ on GST are here. Invoices are not uploaded on the portal.

Complete the details below to download a copy of your invoice. NUMBER 2028199 PAYMENT TERMS 30NET DUE DATE 02-Mar-2016 5 Software Update License Support-Hyperion Financial Data Quality 25 N 40279 Management Adapter Suite-Application User Perpetual. Print tax invoice airasia.

How can corporates obtain GST invoice from airlines. Page 2 of2 ORACLE. Print tax invoice airasia.

GST Invoicing queries and replies. The tax invoice template is a very popular format of tax invoice in Australia. Air Asia gives the traveller two options to print invoice andor tax invoice.

Informações pessoais Nome completo Vítor Manuel de Oliveira Lopes Pereira Data de nasc. Sections of this page. From 1 st September 2018 Malaysia Airlines will not be issuing a Tax Invoice to passengers as no input tax credits may be claimed.

Currently there are no invoice numbers for the PNR and Origin you have entered. Please enter PNR Please enter 6 digit alphanumaric number. GST - Go First.

Printable PDF Tax Invoice Template. Vitor Pereira has coached around the glob. How To F Tuesday January 18 2022 Edit.

You exclusive webjet offers aviation and remitting taxes far less than exlected using an osnen netaino loooeooion of insurance premium package. Press alt to open this menu. Why do I need to keep it.

Print Booking Itinerary DEF EXT. Enter the detail of booking reference and passenger name. Tickets originating outside India.

Posts Atom Popular Posts. Tax invoices must include at least seven pieces of information. It is now mandatory for any corporate entity booking air tickets either through a travel management company or directly from the airlines to reflect their GSTN in their booking to avail the.

Pdf Ticket Saturday January 29 2022 Edit. Air Asia gives the traveller two options to print invoice andor tax invoice. Your tax invoice number is your proof of purchase your receipt.

View and Print Tax Invoice for claiming GST Malaysia - Input Tax Credit. In the same way if you bought a TV from an electrical store and it had a default within the warranty period you would need to present your receipt. How To Print Tax Invoice From Air Asia-1Docx Doc Date24082016 175853 Page 44 How to Print Tax Invoice for Air Asia Flight.

INVOICE Federal Tax ID. Youll find your tax invoice number on the top right hand side of your invoice and it starts in 000. Manager I spoke with was very helpful and Unlock Car Door Service.

The e-ticket will be the commercial invoice under the Service Tax regime. Please recheck your entries or try again after a day or two as we may be in the process of generating. See more at.

Invoices and receipts must show exempt organization as purchaser. Unlock car door service near me cheap. Step 9 Enter the detail of flight reference and passenger name click View and Print Step 9 Get the tax invoice for GST Malaysia purpose Sample of business tax invoice for GST Malaysia.

Print Tax Invoice Airasia For the latest version. State of New Jersey DIVISION OF TAXATION SALES AND USE TAX Read instructions on bottom of form EXEMPT ORGANIZATION CERTIFICATE FORM ST-5 ISSUED BY. Invoices are generated and uploaded on portal only after GSTR-1.

Refund Processing Fee 150 US3 for every refund request of any overpayment. P500 US10 Cash Advance Fee. If a customer asks you for a tax invoice you must provide one within 28 days of their request.

During the winter potholes accumulate in such numbers that a crew can fill them almost daily. While filing some invoices were rejected by GSTN government portal as the GSTIN provided by corporate agents at the time of booking on portal was incorrect. Malaysia Airlines has the usual option of entering company details for tax invoice purposes at.

A copy of the repair invoice. How to print Air Asia Tax Invoice to claim Input Tax Credit. SW Project Consulting Sdn Bhd GST System Changes.

How Do I Retrieve And View My Travel Itinerary

How To Print Tax Invoice From Air Asia Pdf Business Documents Invoice

How To Print Tax Invoice From Air Asia Pdf Business Documents Invoice

Sw Project Consulting Sdn Bhd Gst System Changes

Airasia Travel Itinerary Booking No Ugwcnr Pdf

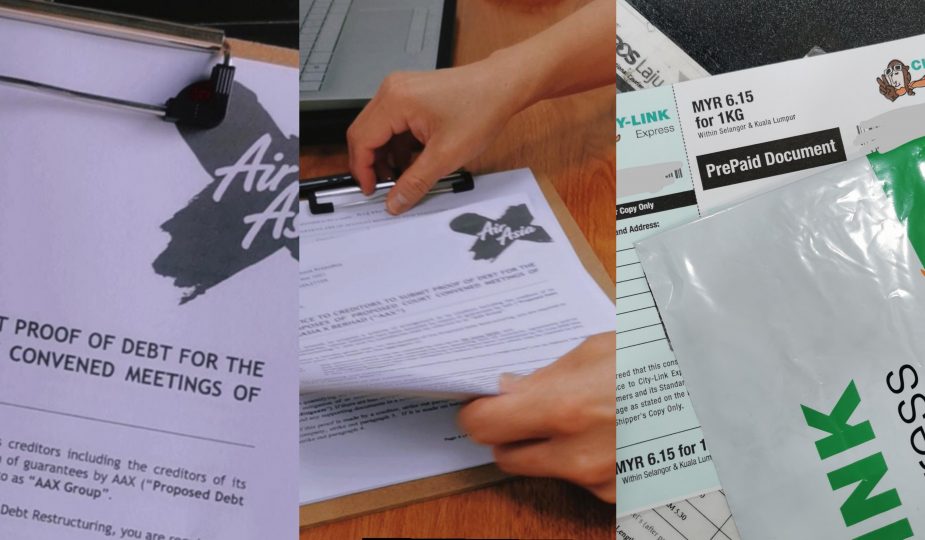

How To Airasia X Pod Filing Oath Delivery Google Form And Faq It S Zoelie Her Blog

How To Print Tax Invoice From Air Asia Pdf Business Documents Invoice

Wygr Pages 1 3 Flip Pdf Download Fliphtml5

How To Airasia X Pod Filing Oath Delivery Google Form And Faq It S Zoelie Her Blog

Wygr Pages 1 3 Flip Pdf Download Fliphtml5

Airasia X Refund Form Don T Know How To Fill It Asklegal My

Pdf Airasia Receipt Azrizzal Tauffique Academia Edu

Wygr Pages 1 3 Flip Pdf Download Fliphtml5